I've been self-employed for 12 years now, and all along the way, I've sort of fumbled through the business side of things.

For the first few years, I worked with a local tax firm in my small town.

I initially filed as a sole proprietorship, and that was fine for the time being. My business didn't generate a ton of revenue, and I handled my own bookkeeping, so I knew exactly how much to set aside for the tax bill in April.

But as time went on, my business became a bit more complex.

I started managing a few brands' social media accounts, so I wanted to switch to an LLC to add a layer of protection around potential liabilities. At the time, it felt very scary to be personally on the hook should anything go wrong.

Social media was the Wild West, and it felt irresponsible to have my personal assets at risk. What if something got hacked? An LLC just made sense.

I got that set up via LegalZoom, switched to quarterly estimated tax payments, and I started paying myself a salary instead of just doing random draws.

Unfortunately, things were never quite right.

As a company of one, my operation was tiny compared to the other multi-person operations this firm did taxes/books for, so I wasn’t a priority. I get it! My revenue was way smaller than their bigger business clients.

But being last on the priority list came with some real downsides.

One year, they filed an extension on my taxes and waited until the last minute (12 pm on October 15, I kid you not), rushing through the submission only to have it rejected (which also meant I incurred penalty fees for being late on taxes due). Cue scary letters from the IRS.

They also didn't really understand my business as a freelancer, and in hindsight, some of their guidance meant I ended up paying WAY more in taxes than I probably should have.

But that's not all.

Year after year, even after switching to monthly estimated tax payments, come April, I'd get hit with a five-figure balance due.

No tax return refund. Ever.

The opposite, in fact; a real gut punch to see a number that big due when you've been trying to stay on track with estimated payments all year long!

I'd ask around to local friends and online, trying to see if anyone knew of a better option. I was desperately looking for a CPA firm or SaaS that specialized in working with solopreneurs/freelancers.

One year, I found a firm in Florida that a fellow freelancer recommended. I was thrilled, but during the onboarding call, they informed me that they were raising their new client fee to $10,000 per year, and that my business's revenue was technically too small to be considered a new customer of interest to them. Sigh.

Things only got trickier when I dissolved my existing LLC and moved to another state.

Then it was crunch time; I had to set up a new LLC before year-end and had NO IDEA how to do any of that. Nor who was going to help me with bookkeeping and taxes moving forward.

So I did what any desperate person would do and GOOGLED THE HELL OUT OF POSSIBLE SOLUTIONS.

The best option I found was Collective.

Not only was it affordable (I think I paid around $3,800 for my annual fee; so much lower than the $10,000 quote from the Florida firm!), but I talked to a REAL PERSON who advised me on what would be best for setting up a new LLC structured as an S Corp, which came with significant savings around payroll taxes.

Other things I like about it:

If I ever have Qs (about things like tax deductions, filing dates, bank integrations, etc.), they have a messaging center where I can submit those and typically hear back within 24 hours from the best person on their team who handles that.

I used their integrated tax partner, Taxfyle, for my annual taxes (an extra flat fee of $199) and was able to upload all my documents and chat with the person doing my filing online in real-time.

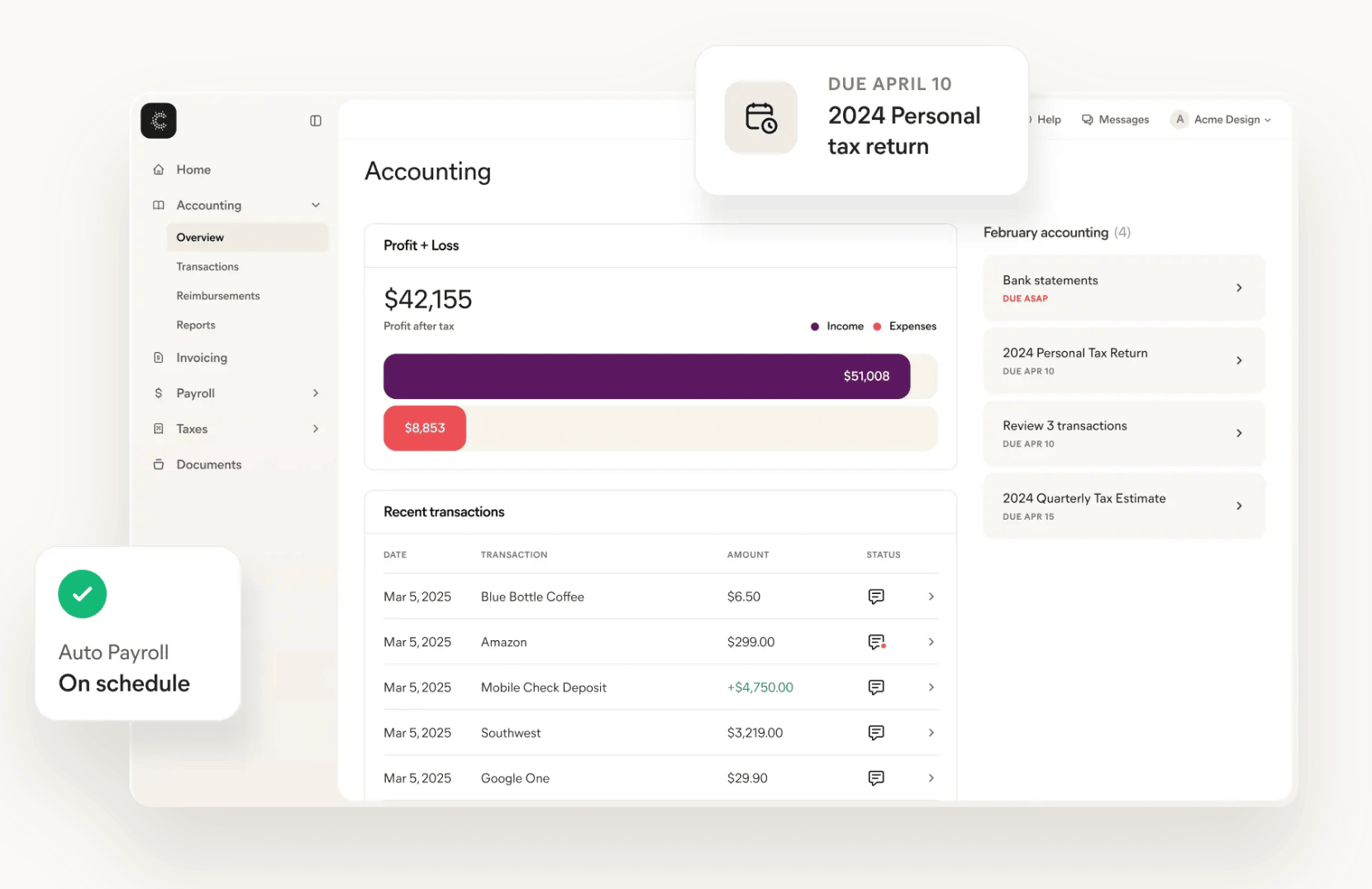

I got rid of my Wave bookkeeping service (I was paying $2,748/year for it!) and now do that right within Collective.

Bonus: Gusto for payroll is already integrated, and there's no extra fee for that! This automatically calculates/pays your monthly estimated tax payments. ✨

Their analytics are great, and I can see a dashboard of my earnings to expenses right when I log in.

I can send contractor payments within Collective, which makes sending accurate 1099s at year-end a single click.

Pricing is a monthly or annual flat fee, and pretty affordable (worth every penny for keeping my sanity/getting this piece of running my business off my desk!)

Long story short: I've been using this platform for over a year now, and I just have to say to anyone out there who's looking for a means of simplifying bookkeeping, taxes, and business setup: Run, don't walk, to Collective.

Last year, I got my first-ever tax refund.

I cannot explain to you what a relief that was after so many years of owing a HUGE balance come tax time.

They have a great referral program, so if you're curious, you can use this link or code KALEIGHMOORE to get a full month free (up to $350 in savings!)